Standard | Limited Company | HMO & MUFB

Standard:

- Up to 75% LTV

- Initial rate from 4.59%

- Up to 7 year fixed

- Fee’s from £0

Limited Company:

- Up to 75% LTV

- Initial rate from 4.59%

- Up to 7 year fixed

- Fee’s from £0

HMO & MUFB:

- Up to 75% LTV

- Initial rate from 4.99%

- Up to 7 year fixed

- Fee’s from £0

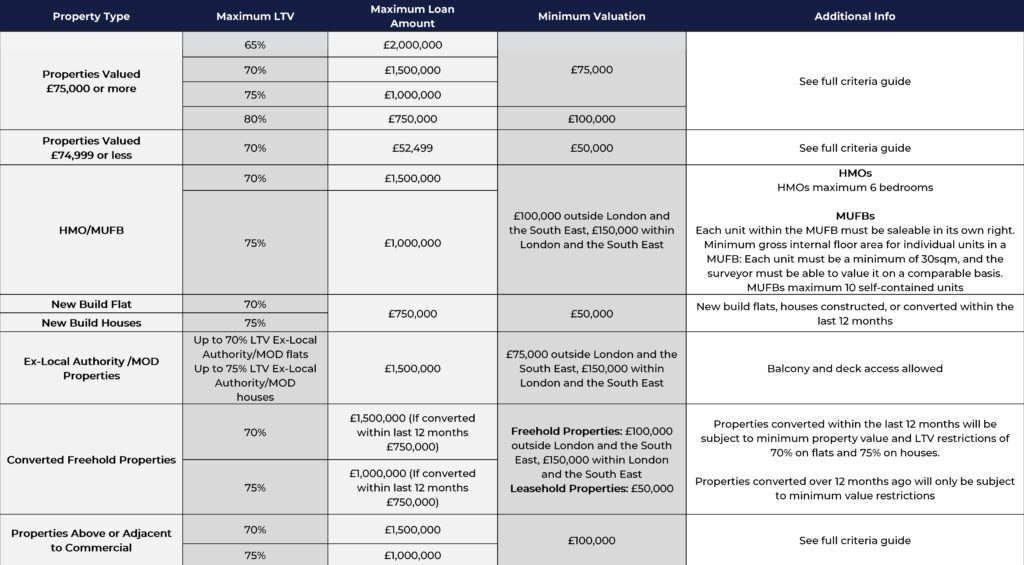

Key Criteria:

Product information correct as of 13/02/2024.

For intermediaries only.

Your home may be repossessed if you do not keep up repayments on your mortgage or a loan secured against it.

The Financial Conduct Authority does not regulate some aspects of corporate financial planning, property investment or buy to let lending.